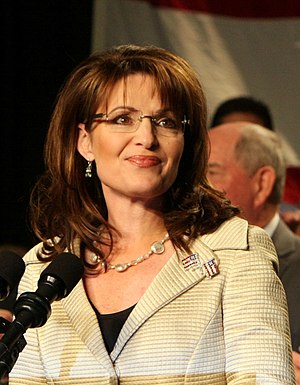

Palin takes a stand on monetizing the debt

Image via Wikipedia

Image via WikipediaIt would be hard to find two more unlikely intellectual comrades than Robert Zoellick, the World Bank technocrat, and Sarah Palin, the populist conservative politician. But in separate interventions yesterday, the pair roiled the global monetary debate in complementary and timely fashion.The Palin principals also were mentioned in the UK's liberal Guardian. She joins critics from around the world on the issue.

The former Alaskan Governor showed sound political and economic instincts by inveighing forcefully against the Federal Reserve's latest round of quantitative easing. According to the prepared text of remarks that she released to National Review online, Mrs. Palin also exhibited a more sophisticated knowledge of monetary policy than any major Republican this side of Wisconsin Representative Paul Ryan.

Stressing the risks of Fed "pump priming," Mrs. Palin zeroed in on the connection between a "weak dollar—a direct result of the Fed's decision to dump more dollars onto the market"—and rising oil and food prices. She also noted the rising world alarm about the Fed's actions, which by now includes blunt comments by Germany, Brazil, China and most of Asia, among many others.

"We don't want temporary, artificial economic growth brought at the expense of permanently higher inflation which will erode the value of our incomes and our savings," the former GOP Vice Presidential nominee said. "We want a stable dollar combined with real economic reform. It's the only way we can get our economy back on the right track."

Mrs. Palin's remarks may have the beneficial effect of bringing the dollar back to the center of the American political debate, not to mention of the GOP economic platform. Republican economic reformers of the 1970s and 1980s—especially Ronald Reagan and Jack Kemp—understood the importance of stable money to U.S. prosperity.

...

... Mrs. Palin is way ahead of her potential Presidential competitors on this policy point, and she shows a talent for putting a technical subject in language that average Americans can understand.

Which brings us to Mr. Zoellick, who exceeded even Mrs. Palin's daring yesterday by mentioning the word "gold" in the orthodox Keynesian company of the Financial Times. This is like mentioning the name "Palin" in the Princeton faculty lounge.

...

I am wondering if the Fed was was actually forced to do it because of a lack of buyers for our current debt instruments. That would suggest the Federal Government was approaching insolvency itself. The amount of debt the Obama administration is asking the world to absorb is unprecedented. It may take severe cuts to realign our debt with the available capitol.

Comments

Post a Comment